Gold Plays in 595 range.

Due to Crude Oil price falling yesterday, Gold followed the same path, and didnt recognize the Weakness in Dollar.

It looks like we might expect a DownFall today, if we dont see any Quick rally upwards.

Any GeoPolitical Tensions, could presumably support the price,

Presently prices are in tight Mixed range, whether they go up, whether go down.

Technically, we expect it to go down, as Signs passes by, However, we could expect a Good Suprise if Gold focuses little in Dollar weakness, and rallies happily Upwards.

Around 2 Hours past for Asia Market to open, We shall Await India Market and few Other top Asian Countries to open, which may Support the prices, in Physical Buying Pressure.

However, European Physical Buyers have started to buy Gold at such low prices, and Stocking them up for the upcoming Christmas festive.

Such Support is indeed warming up the table, Which is IMPORTANT.

Main Co-relation of Precious Metals is Crude Oil, So Keep Focus on Crude Oil Prices for the moment.

As Various traders expect, this week we could see a Push in Crude Oil prices, which is eventually Indeed awaited, As It Appears, Commodities, Energy has touched the Down Levels, and we could expect a Rebound very soon, entering the 4th Quarter of this Year, bringing in New Investments in such sectors.

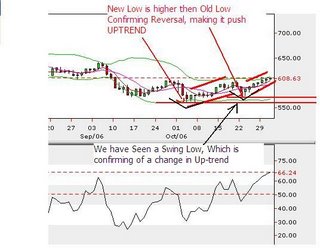

Weekly Outlook on Gold, Gold has broken the Triangle, clearly shown in the Chart.

Weekly Outlook on Gold, Gold has broken the Triangle, clearly shown in the Chart.