Gold gave a nice Push today (Wednesday) And brought the price at 589 Levels.

After 5 day Continous Down Fall, We saw the charts with a Bright Green Bar :)

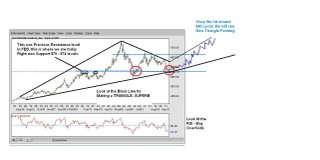

It Appears that 579 is a very Important Zone, crossing that we will eye for 574 or even Meeting the Old 200 MA level which was 543.

However, looking for the moment, We see USD weakness starting to appear, Also Crude Oil Mantained a Slight Push today, Which indeed supported Precious Metals.

For the moment, we shall Expect Range Bound trading, as we have seen in April 2006 and June 2006.

Crossing 593 and 600, Clears the Primary Resistance zone, And Indicates Slightly for a reversal Pattern to develop.

Next week, shall be an Important week for all, Where FOMC makes a Decision of whether a Hike or Pause,

Now right now Market wants them to Hike, Economists have Expected for the No Hike.

In our view we expect for No Hike to be seen.

However, we shall see next week what decision they Comply with.

Next week shall be Considered as Important, where everything Might go crazy on the Boards.

SO YOU SHOULD BE PREPARED.

In precious Metals, what we expect is Same range bound till Friday, A Big Gap shall open Next week, Helping the Metals for a Nice steady rise.

Once a Reversal Appears, We might call for 730 Again in the Books.

Reasons, Much Money will start to flow again in the Precious Metals Market, Everyone is Back home after Vacations, wedding festive, Physical Buying will solidify, Dollar shall weaknen, And various other factors which shall Boost the Precious Metals in a STEADY Manner.

ONCE AGAIN BE PREPARED EVEN FOR ANY DOWNFALL OR A RISE, YOU SHOULD BE READY, AND HAVE GOOD HOLDING ACCOUNT POWER.

BUT AS THINGS APPEARS, we are looking for a Push Soon. Traders are really tired for this DownFall, A Big Dip considered, But Healthy for long term - DEFINATELY.